SSE STAR Market Scores First Century of Listed Companies

This is the central arena of capital serving scientific and technological innovation. This is where new attempts are made to allocate capital resources for the supply-side reform.This is where China's new economy integrate with the world. Since its opening, the Science and Technology Innovation Board of the Shanghai Stock Exchange (the SSE STAR Market) has featured new-born hope and spirit of reform in the past nine months. Today, the "STAR 100" companies have made their collective debut, and are playing the leading role of the "test field" for deepening the reform of the capital market.

1. Stimulating the vitality of the science and technology innovation

The SSE STAR Market plays an important role in guiding innovation resources, capital, and personnel development of innovative enterprises. The total financing amount of the 100 companies listed on the SSE STAR Market (the “STAR companies” for short) reaches RMB118.8 billion. Particularly, China Railway Signal & Communication Corporation Limited raised more than RMB10 billion in the initial public offering (IPO), with the IPO financing of more than RMB4 billion recorded by Beijing Kingsoft Office Software, Inc., Beijing Roborock Technology Co., Ltd. and China Resources Microelectronics Limited.

| Capital Raised (RMB100 million) | IPO Capital Raised (RMB100 million) | Company Name |

| ≧100 | 105.30 | China Railway Signal & Communication Corporation Limited |

| ≧40 | 46.32 | Beijing Kingsoft Office Software, Inc. |

| 45.19 | Beijing Roborock Technology Co., Ltd. | |

| 43.13 | China Resources Microelectronics Limited | |

| ≧20 | 28.12 | Shenzhen Transsion Holdings Co., Ltd. |

| 28.02 | Montage Technology Co., Ltd. | |

| 24.12 | National Silicon Industry Group Co., Ltd. | |

| 23.69 | Bloomage Biotechnology Corporation Limited | |

| 20.26 | Suzhou Zelgen Biopharmaceuticals Co., Ltd. |

2. Highlighting the effect of Science and Technology Innovation on the STAR Market

Market capitalization is the goal pursued by both investment and financing sides in the context of a market economy, and most authentically reflects the value of an enterprise. As a nascent sector deeply imprinted with the genes of the new economy, the SSE STAR Market has creatively set up a "market cap-centered" system of listing indicators, which expands investors' understanding of the core value of the companies characterized by the new economy, from the traditional “profit orientation” to the “value orientation”. By April 28, the market capitalization of the "STAR 100" companies has exceeded RMB1.3 trillion. Among the companies, there are two posting a market capitalization of more than RMB100 billion, with Beijing Kingsoft Office Software, Inc. and Montage Technology Co., Ltd. amounting to RMB117.9 billion and RMB106.8 billion in total market value respectively, which rank 43rd and 52nd respectively among all the SSE-listed companies. 39 companies have registered a market capitalization of more than RMB10 billion. The STAR Market is starting to play a guiding and exemplary role.

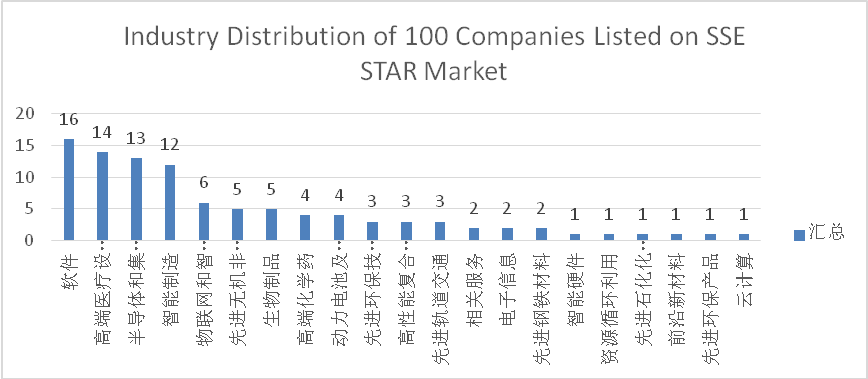

3. Clustering of science and technology innovation industries

The 100 companies listed on the SSE STAR Market are highly concentrated in the high-tech industries and strategic emerging industries, presenting the leading companies of various industry segments. Among the 100 companies, those in the new-generation information technology and the bio-pharmaceutical sectors account for more than 60% of the total, with 39 and 25 enterprises respectively, and there are 15, 12 and 9 companies in the sectors of high-end equipment, new materials, and energy conservation and environmental protection respectively.

In particular, a number of companies with key technology and outstanding capabilities of technological innovation in the high-end medical equipment, integrated circuits, biomedicine and other industries have been attracted to the SSE STAR Market for listing, and some notable companies with high market recognition and strong capacity for scientific and technological research have joined the market.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | Total |

| 1. | Software | ||||||||||||||||||||

| 2. | High-end Medical Equipment | ||||||||||||||||||||

| 3. | Semiconductor and Integrated Circuit | ||||||||||||||||||||

| 4. | Intelligent Manufacturing | ||||||||||||||||||||

| 5. | Internet of Things | ||||||||||||||||||||

| 6. | Advanced Inorganic Nonmetallic Materials | ||||||||||||||||||||

| 7. | Biological Products | ||||||||||||||||||||

| 8. | High-end Chemical Medicine | ||||||||||||||||||||

| 9. | Power Battery | ||||||||||||||||||||

| 10. | Advanced Technology of Environmental Protection | ||||||||||||||||||||

| 11. | High-performance Composites | ||||||||||||||||||||

| 12. | Advanced Rail Transit | ||||||||||||||||||||

| 13. | Relevant Services | ||||||||||||||||||||

| 14. | Electronic Information | ||||||||||||||||||||

| 15. | Advanced Steel and Iron Materials | ||||||||||||||||||||

| 16. | Intelligent Hardware | ||||||||||||||||||||

| 17. | Cyclic Utilization of Resources | ||||||||||||||||||||

| 18. | Advanced Petrochemical | ||||||||||||||||||||

| 19. | Cutting-edge New Materials | ||||||||||||||||||||

| 20. | Advanced Products of Environmental Protection | ||||||||||||||||||||

| 21. | Cloud Computing | ||||||||||||||||||||

4. The key indicators that underscore the quality of the STAR companies.

Research and development (R & D) serves as the "engine" for the STAR companies. The R & D investment of the 100 STAR companies accounts for 11.97% of the operating income on average, with the R & D proportions of Shenzhen Chipscreen Biosciences Co., Ltd., Beijing Kingsoft Office Software, Inc. and Hitgen Inc. exceeding 30%. The average number of the R & D personnel at the companies is 275, or 31.1% of the total number of employees on average. Quite a few STAR companies have continued to increase their investment in R & D after listing. In their analysis of the factors boosting their performance growth, the vast majority of companies believe that stepping up the R & D investment and enhancing the research and development of new products have contributed to the company's steady expansion.

Patents are the "muscles" of the STAR companies. The 100 STAR companies each have an average of 75 invention patents, 58 utility model patents and 62 software copyrights. On average, each STAR company owns a total of 201 patents.

High-end talents act as the "brain" of the STAR companies. Among the core technical personnel recognized by the 100 STAR companies, there are 142 with a PhD degree, accounting for 23.83% of the total, and 220 with a Master’s degree, accounting for 36.91% of the total. Among all the chairpersons of the 100 STAR companies, 27 have a PhD, accounting for 27% of the total, and a total of 43 have a Master's degree, representing a proportion of 43%.

5. Financial data shows growth momentum.

Overall performance

In 2019, the operating performance of the STAR companies steadily improved. Both the overall revenue and profit grew, with the total operating income amounting to RMB146.927 billion, an increase of 14.21% year-on-year, and the total net profit standing at RMB17.731 billion, up by 24.50% year-on-year. Note: The main source of the data is the flash reports on performance in 2019. Some come from 2019 annual reports and prospectuses (same below).

Operating income

The median of the growth rates is 19.97%. There are 28 companies with a revenue of more than RMB1 billion and 70 companies with an income of RMB1-10 billion.

Table: Operating Income of STAR Companies in 2019

| Change in Operating Income | 2019 | |

| Number of Companies | Proportion (%) | |

| Year-on-year Growth ≥ 5 0% | 8 | 8 |

| 20% < Year-on-year Growth ≤ 50% | 40 | 40 |

| 0% < Year-on-year Growth ≤ 20% | 39 | 39 |

| Year-on-year Decline | 12 | 12 |

| Not Applicable | 1 | 1 |

| Total | 100 | 100 |

Net profit

The median net profit of the 100 STAR companies is RMB95 million, with the median growth rate of net profit at 22.12%. The net profits of 40% of the companies stand in the range of RMB50 to 100 million, with 50% of the companies recording a net profit of more than RMB100 million.

Table: Net Profit of STAR Companies in 2019

| Change in Net Profit | 2019 | |

| Number of Companies | Proportion (%) | |

| Year-on-year Growth > 100% | 5 | 5 |

| 50% < Year-on-year Growth ≤ 100% | 21 | 21 |

| 0% < Year-on-year Growth ≤ 50% | 51 | 51 |

| Year-on-year Decline | 21 | 21 |

| Continued Loss | 2 | 2 |

| Total | 100 | 100 |

Highlights:

Small and medium-sized STAR companies demonstrate growth potential

After categorizing the STAR companies by asset size, it was found that the small and medium-sized STAR companies registered a higher average annual income growth in 2019, showing the growth potential of such companies; the large-sized STAR companies posted a higher average growth rate of net profit attributable to the owners of the parent company, reflecting the positive scale effect on improving profitability.

Company Size and Performance Growth (unit: %)

| Company Size | Number of Companies | Year-on-year Average Income Growth Rate | Year-on-year Average Growth Rate of Net Profit Attributable to the Owners of the Parent Company |

| Large Companies (Total Assets ≥ RMB10 billion) | 3 | 2.53 | 59.36 |

| Medium-sized Companies (RMB1 billion ≤ Total Assets < RMB10 billion) | 70 | 22.78 | 11.12 |

| Small-sized Companies (Total Assets<RMB1 billion) | 27 | 22.57 | 40.80 |

Note: Not applicable to Bio-Thera Solutions Ltd. and Suzhou Zelgen Biopharmaceuticals Co., Ltd.

The leading companies on the board play a significant role

According to the distribution of the business results, in 2019 the top ten companies in terms of revenue on the SSE STAR Market recorded a total operating income of RMB92.021 billion, a year-on-year increase of 9.19%, accounting for 62.63% of the overall operating income of the sector; the total net profit amounted to RMB8.198 billion, up by 32.29% year-on-year, accounting for 46.24% of the total for the board.

6. Mapping the productivity of science and technology innovation

From a geographical point of view, the distribution of the "STAR 100" companies is highly consistent with the regional layout of science and technology innovation productivity in China. Among the companies, 17 are registered in Beijing, 18 in Guangdong, 17 in Jiangsu, 16 in Shanghai, and 10 in Zhejiang.

7. Five tailor-made sets of standards for listing

For companies not yet making a profit, red chip companies, companies with weighted voting rights, etc., the SSE STAR Market, born to cultivate the enterprises of sci-tech innovation with international competitiveness, provides five sets of standards for listing, opening the door for various types of companies of sci-tech innovation to go public in China. Judging from the 100 listed companies, the five sets of listing standards basically cover the current development situations of the domestic enterprises characterized by sci-tech innovation. Among the companies, 87 chose the most conventional first set of listing standards, namely "market value + net profit / revenue"; Sino Medical Sciences Technology Inc. adopted the second set of standards featuring "market value + income / proportion of R & D investment"; Suzhou Tztek Technology Co., Ltd. selected the third set of standards with "market value + revenue + cash flow"; 7 companies including China Railway Signal & Communication Corporation Limited and National Silicon Industry Group Co., Ltd. opted for the fourth set of standards based on "market value + revenue"; Bio-Thera Solutions Ltd. and Suzhou Zelgen Biopharmaceuticals Co., Ltd., two companies not yet making a profit, applied the fifth sets of standards focusing on "market value". In addition, the standards for red-chip enterprises were applied to China Resources Microelectronics Limited, and the standards of weighted voting rights were applied to UCloud Technology Co., Ltd.

8. Looking ahead

Amid the systematic reform of the capital market, the SSE STAR Market, serving as the pioneers, will continue to step forward firmly and bravely with the strong support provided by all parties concerned, carrying forward the pride and aspirations to achieve the goal of making our country stronger and realizing the Chinese Dream.

The SSE STAR Market is a gift for the 30th anniversary of the establishment of China's capital market, as well as a major step in the central arena of the national economy and sci-tech innovation.